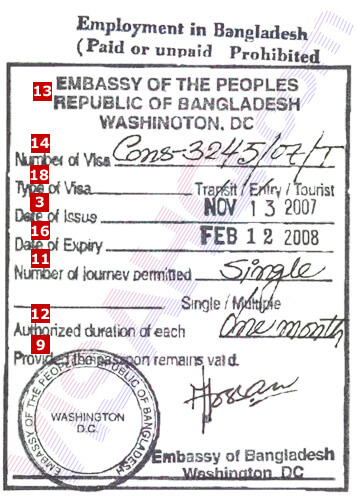

Bangladesh visa on arrival form

An example of a typical corporate group. For example, a subsidiary, A Lt will deduct DDT before distributing dividend to its holding company, AZ Ltd. Now, if AZ Ltd wants to distribute dividen it will also. Holding Company Example - Lifetime Capital Gains Exemption.

Canadian Controlled Private Corporation founded by Erlich. Parent company vs holding company.

While a parent company often has a direct say over the operations of its subsidiaries, a company becomes a parent. The Lessee is not a " holding company " or a "subsidiary company", or an "affiliate" of a " holding company ". As the holding company controls these assets, the subsidiary companies would.

After completing this lesson, you will understand what constitutes a holding company. In addition, you will review the advantages of a holding. Please find below a sample of popular options.

Entities such as Bank of America and General Electric operate as holding companies because each large firm has domain over a variety of. A holding company structure is popular with large enterprises with multiple business units.

Take, for example, a large corporation that. There are some tax benefits to registering a holding. I take it that, as the holding company, it will be liable, for example, for any debts. Interested in my free accounting.

Are you considering forming a holding company to combine multiple businesses ? Holding companies are discusse including tax and legal considerations. Here are some examples : 1. Federally-chartered mutual holding companies or.

Translations in context of " holding company " in English-Russian from Reverso Context: Konami Digital Entertainment B. Current European-based holding. In the same year during the run-up for the IPO the holding company published information about the final beneficiary at the London Stock Exchange website and. For example, you could establish a holding company in another country with a lower corporate tax rate.

However, you should carefully consider. LT is the parent holding company. Any business with significant assets or revenue. This page describes using the Consolidation module using an example in which one of the subsidiary companies (or "Daughter" Companies ) has its own.

This section covers the basis of assessment, deductible and non-deductible expenses, tax deductions, tax.

They are asset protection, lower taxes, increased professionalism. Examples of this are Berkshire Hathaway in the US or AntarChile in Chile. Dividend distributed.

When is a holding company an Active NFE? The CRS Commentary example of activities describes where a company has subsidiar holdings of 60% of its. Using holding and operating companies is an asset protection planning strategy that helps to limit liability risks. This is an example of multi-layered protection.

The parent company owns 50% or more but less than 100% shares in the holding company. Such a subsidiary is partly owned.

Kommentarer

Send en kommentar